mississippi income tax brackets

In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force. Mississippi Income Taxes.

Mississippi Tax Forms And Instructions For 2021 Form 80 105

The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income.

. 4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax. Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Your average tax rate is. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Under the budget deal struck in 2021 Arizona will gradually reduce.

Single married filing separate. Ad Compare Your 2022 Tax Bracket vs. 3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year.

If you are receiving a refund. Here is information about Mississippi Tax brackets from the states Department of Revenue. Mississippi one of the poorest states in the nation has struggling rural.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 15202. Mississippi Income Taxes. Discover Helpful Information and Resources on Taxes From AARP.

This income tax calculator can help estimate your average income tax rate and your salary after tax. Explore The Top 2 of On-Demand Finance Pros. Mississippi personal income tax rates.

The tax brackets are the same for all filing statuses. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Your 2021 Tax Bracket to See Whats Been Adjusted.

Ad Free tax support and direct deposit. Taxpayer Access Point TAP. The corporate rates and brackets match the individual rates and brackets and the brackets contain a marriage penalty because the rates kick in at the same marginal income levels regardless of filing status.

There is no tax schedule for Mississippi income taxes. Mississippi has a graduated tax rate. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. Any income over 10000 would be taxes at the highest rate of 5.

After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers. All other income tax returns. The graduated income tax.

Mississippi State Personal Income Tax Rates and Thresholds in 2022. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. In early March Iowa passed a historic tax reform package that consolidated its nine individual income tax brackets with a top rate of 853 into a flat rate of 39.

Total income tax -15202. 27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

The following three years the 5 bracket would be reduced to 4. Mississippi Income Tax Calculator 2021. These rates are the same for individuals and businesses.

Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the. AP -- Mississippi residents will pay lower income taxes in coming years as the state enacts its. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately.

4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Individual Income Tax. Additionally the 4 percent bracket includes 5000 of taxable income meaning potential savings would amount to a maximum of 200 per year for single and joint filers.

Mississippi is the third state to do so this year alone and becomes the 12th state to have done so. If youre married filing taxes jointly theres a.

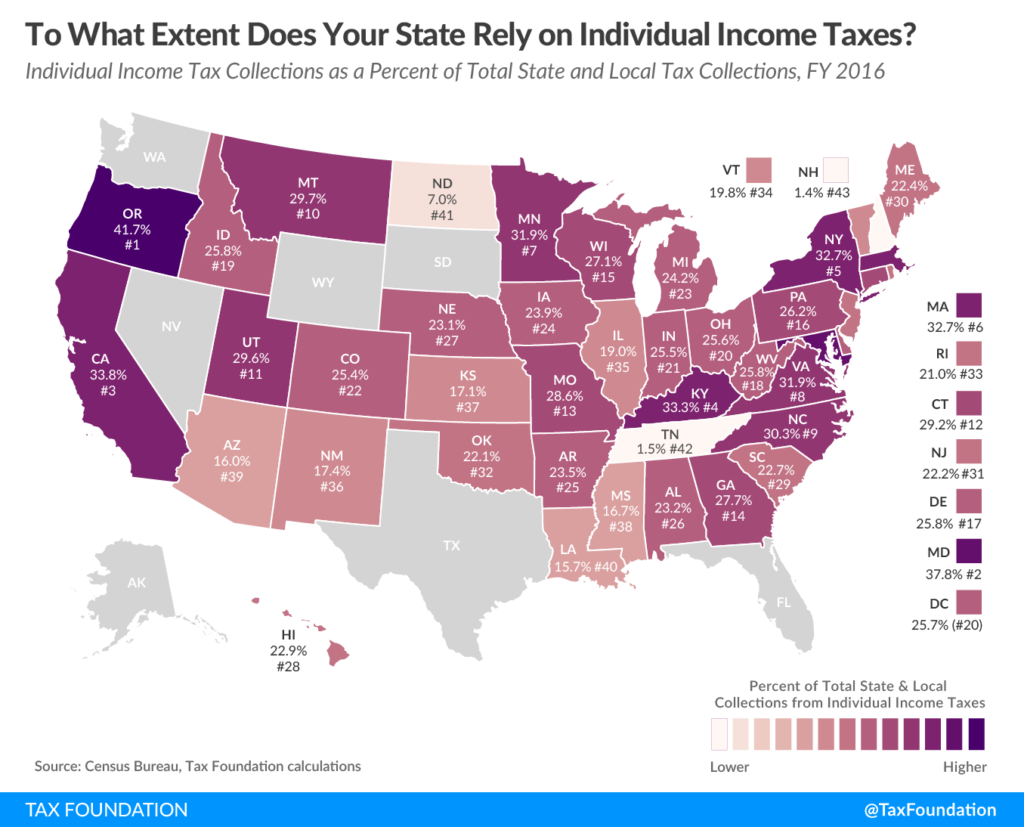

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

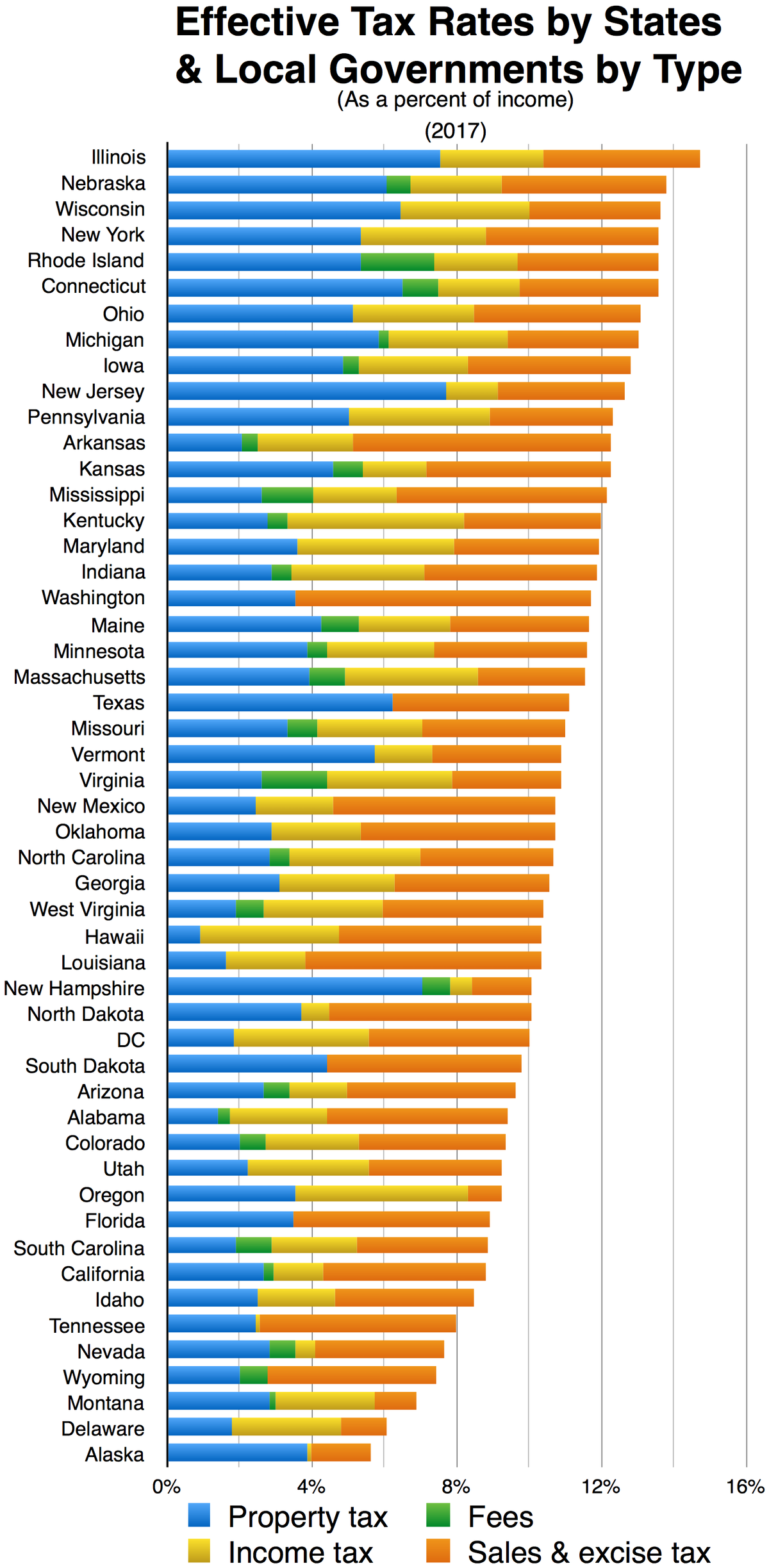

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Combined State And Local General Sales Tax Rates Download Table

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

Historical Mississippi Tax Policy Information Ballotpedia

Strengthening Mississippi S Income Tax Hope Policy Institute

Will 18 Billionaires Solve Illinois Financial Problems Governor Pritzker Has A Hidden Agenda To Increase Everyone S Taxes Roy F Mccampbell S Blog

Wealthy Mississippians Would Benefit Most From Income Tax Elimination Sara Miller Mississippi Economic Policy Center

Mississippi State Tax Tables 2022 Us Icalculator