ct estate tax return due date

The estate tax rate is progressive and payable on the value of the entire taxable estate. Form CT-1120 CT-1120CU for returns due between March 15 2020 and July 15 2020 Corporation Tax Estimated Payments.

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund

IRS Form 1041 US.

. 2021 Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates General Information For decedents dying during 2021 the Connecticut estate tax exemption amount is 71 million. For more information see When to File Form CT-1041 on Page 10. 0620 State of Connecticut Decedents last name First name and middle initial Social Security Number SSN.

2021 Connecticut Estate and Gift Tax Return Instruction. 1082800 plus 16 of the excess. Generally the estate tax return is due nine months after the date of death.

For 2020 that threshold is 51 million. Please note that the. The tax rate ranges from 108 to 12 for 2021 and from 116 to 12 for 2022.

Due Date Extended Due Date. 2 With respect to the estates of decedents dying on or after January 1 2010 but prior to January 1 2011 the tax based on the Connecticut taxable estate shall be as provided in the following schedule. Estates Which Must File Only With Probate Court Form CT-706 NT Connecticut Estate Tax Return for Nontaxable.

When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a. The 2021 Connecticut income tax return for trusts and estates and payment will be considered timely if filed on or before Monday April 18 2022. The decedent and their estate are separate taxable entities.

Form CT-1120ES for any estimated payments due between March 15 2020 and July 15 2020 Estate Tax Return Payment. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2020 Read instructions before completing this form Do not use staples.

A resident estate is an estate of a decedent who was domiciled in. 2018 Connecticut Estate Tax Return For Nontaxable. An estates tax ID number is called an employer identification.

The extended e-File deadline is Oct. Before filing Form 1041 you will need to obtain a tax ID number for the estate. Form CT-706709 for returns due between April 1 2020 and July 15 2020.

14 rows Gas Tax - For detailed information on the Suspension of the Motor Fuels Tax click. The gift tax return is due on April 15th following the year in which the gift is made. All decedents estates required to file an estate tax return in Connecticut are presumed to have been resident in Connecticut at death and the burden of proof is on the decedents estate to prove.

Section 1 - Gift Tax. Keep in mind however a Connecticut or IRS tax extension does not extend the due date to pay owed taxes or income tax liabilities penalty free. Adjustment for any difference in its value as of the later date that is not due to mere lapse of time 26 USC.

Corporation Tax Return Payment. The tax applies only to the value of the estate above the threshold. Steps to Completing Section 1 - Gift Tax.

An example of. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold.

File your 2019 Form CT706709 on or before April 15 2020. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 2 million. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 71 million. 13 rows Only about one in twelve estate income tax returns are due on April 15. That goes up to 91 million in 2022 and 114 million in 2023.

17 2022 and the Connecticut paper filing due date is October 15 2022 October 17 2022. File Only With Probate Court Rev. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Form CT706709 Connecticut Estate and Gift Tax Return is an annual return and covers the entire calendar year. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

The estate tax is due within six months of the estate owners death though a six-month extension may be requested.

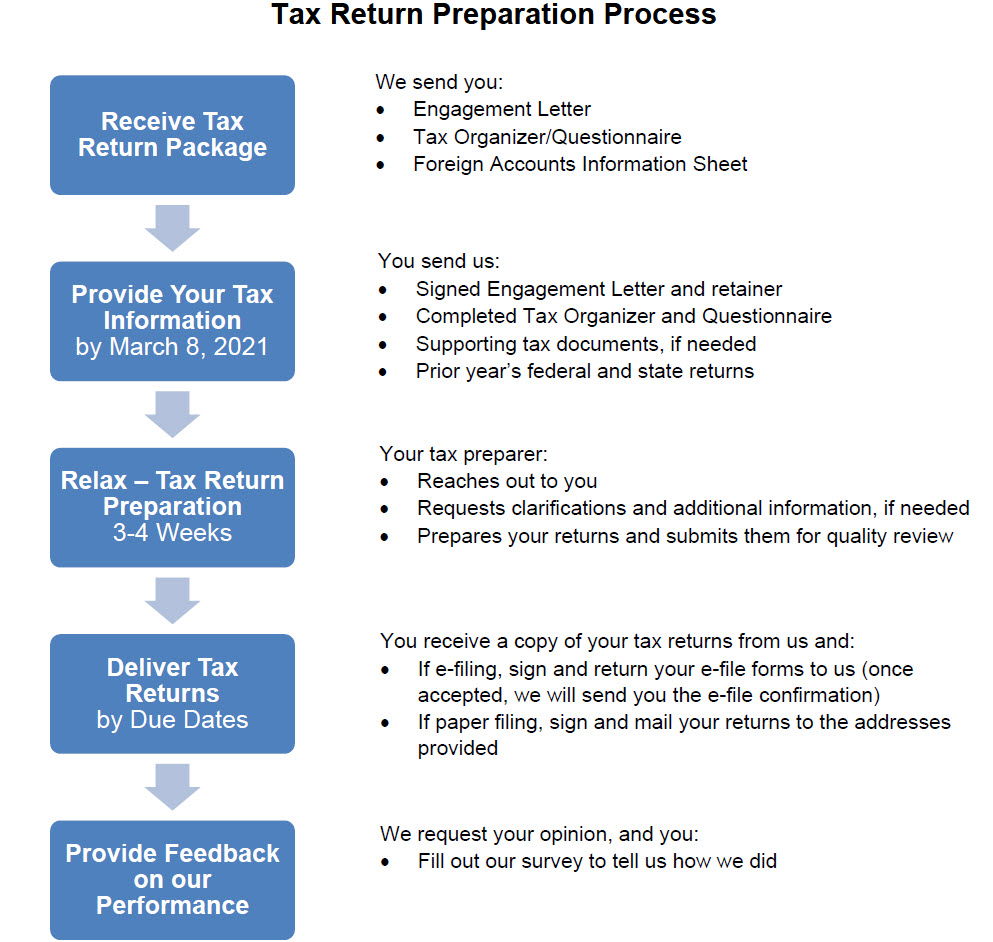

Tax Return Information The Wolf Group

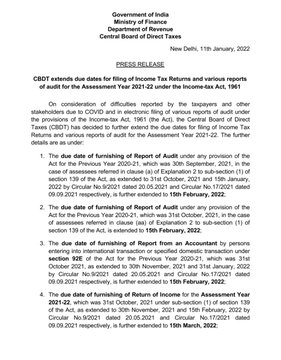

Due Date For Filing Income Tax Returns For Assessment Year 2021 22 Extended To Mar 15 Businesstoday

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Due Dates Department Of Taxation

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Due Date For Filing Income Tax Returns For Assessment Year 2021 22 Extended To Mar 15 Businesstoday

The 2021 Tax Filing Deadline Has Been Extended Access Wealth

When To File Form 1041 H R Block

Gstr 9 Annual Gst Return Filing Form Procedure Due Date Tax2win

Tax Due Dates Town Of Fairfield Connecticut

Federal Income Tax Deadline In 2022 Smartasset

We Make You A Personalized Utility Statement From Southern Connecticut Gas Or The Utility Provider Of Your Choic Credit Card App Energy Bill Worksheet Template

Irs Announces 2022 Tax Filing Start Date

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset